FINANCE [Allowances] DEPARTMENT

G.O.Ms.No.323, Dated 17th October 2019.

(Vihari, Puratasi-30, Thiruvalluvar Aandu 2050)

ABSTRACT

ALLOWANCES – Dearness Allowance – Enhanced Rate of Dearness

Allowance from 1st July 2019- Orders – Issued.

Read the following:-

- G.O.Ms.No.151, Finance (Allowances) Department, dated: 20-05-2019.

- From the Government of India, Ministry of Finance, Department of Expenditure, New Delhi Office Memorandum No.1/3/2019-E-II(B), dated 14-10-2019.

ORDER:

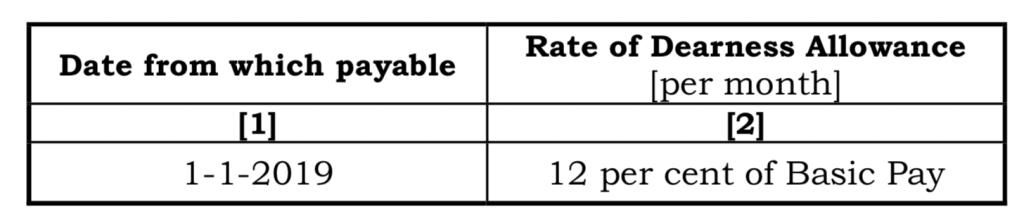

In the Government Order first read above, orders were issued sanctioning revised rate of Dearness Allowance to State Government employees as detailed below:-

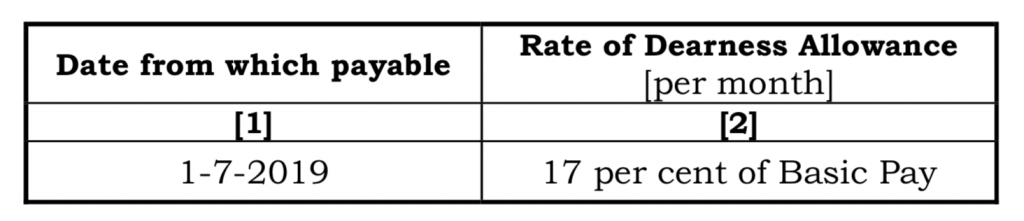

- Government of India in its Office Memorandum second read above has now enhanced the Dearness Allowance payable to its employees from the existing rate of 12% to 17% with effect from 1st July 2019.

- Following the orders issued by the Government of India, the Government sanction the revised rate of Dearness Allowance to the State Government employees as indicated below:

- The additional instalment of Dearness Allowance payable under these orders shall be paid in cash with effect from 1-7-2019.

- The payment of arrears of Dearness Allowance from July, 2019 to September, 2019 shall be drawn and disbursed immediately by existing cashless mode of Electronic Clearance System (ECS). While working out the revised Dearness Allowance, fraction of a rupee shall be rounded off to next higher rupee if such fraction is 50 paise and above and shall be ignored if it is less than 50 paise.

- The Government also direct that the revised Dearness Allowance sanctioned above shall be admissible to full time employees who are at present getting Dearness Allowance and paid from contingencies at fixed monthly rates. The revised rates of Dearness Allowance sanctioned in this order shall not be admissible to part time employees.

- The revised Dearness Allowance sanctioned in this order shall also apply to the teaching and non-teaching staff working in aided educational institutions, employees under local bodies, employees governed by the University Grants Commission/All India Council for Technical Education scales of pay, the Teachers/Physical Education Directors/Librarians in Government and Aided Polytechnics and Special Diploma Institutions, Village Assistants in Revenue Department, Noon Meal Organisers, Child Welfare Organisers, Anganwadi Workers, Cooks, Helpers, Panchayat Secretaries/Clerks in Village Panchayat under Rural Development and Panchayat Raj Department and other employees drawing pay in the prescribed Level of Pay in the Special Pay Matrix.

- The expenditure shall be debited to the detailed head of account “03. Dearness Allowance” under the relevant minor, sub-major and major heads of account.

- The Treasury Officers / Pay and Accounts Officers shall make payment of the revised Dearness Allowance when bills are presented without waiting for the authorization from the Principal Accountant General (A&E), Tamil Nadu, Chennai-18.