The General Financial Rules (GFR) 2017 are applicable to all Central Government Ministries/Departments, attached and subordinate bodies, except Autonomous Bodies with separate Financial Rules approved by the Government. The GFR includes definitions for various terms used in the rules, such as Accounts Officer, Competent Authority, Controlling Officer, Drawing and Disbursing Officer, and Head of the Department, among others. It also includes definitions for financial terms such as Appropriation, Consolidated Fund, Contingency Fund, Government Account, and Public Account. The GFR also explains the CAPEX and OPEX models used for purchasing goods and services. The latest compilation of amendments to the GFR is up to 31.01.2023.

Compilation of amendments in GFR 2017 upto 31.01.2023

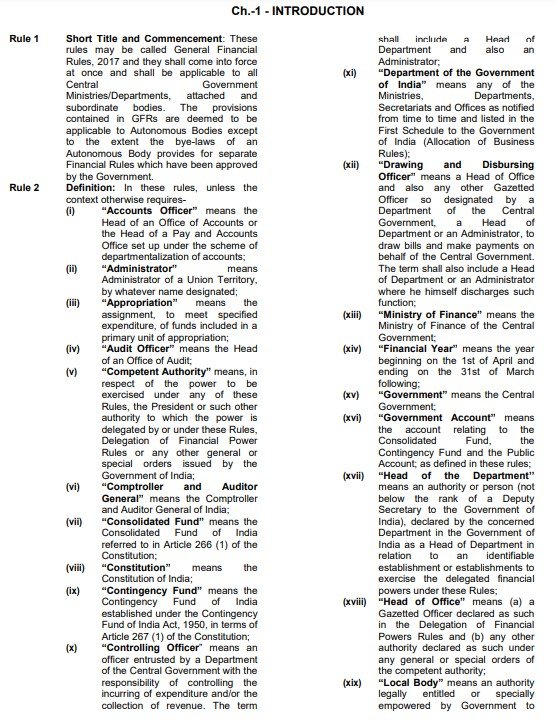

Ch.-1 – INTRODUCTION

Rule 1 Short Title and Commencement: These rules may be called General Financial Rules, 2017 and they shall come into force at once and shall be applicable to all Central Government Ministries/Departments, attached and subordinate bodies. The provisions contained in GFRs are deemed to be applicable to Autonomous Bodies except to the extent the bye-laws of an Autonomous Body provides for separate Financial Rules which have been approved by the Government.

Rule 2 Definition: In these rules, unless the context otherwise requires-

(i) “Accounts Officer” means the Head of an Office of Accounts or the Head of a Pay and Accounts Office set up under the scheme of departmentalization of accounts;

(ii) “Administrator” means Administrator of a Union Territory, by whatever name designated;

(iii) “Appropriation” means the assignment, to meet specified expenditure, of funds included in a primary unit of appropriation;

(iv) “Audit Officer” means the Head of an Office of Audit;

(v) “Competent Authority” means, in respect of the power to be exercised under any of these Rules, the President or such other authority to which the power is delegated by or under these Rules, Delegation of Financial Power Rules or any other general or special orders issued by the Government of India;

(vi) “Comptroller and Auditor General” means the Comptroller and Auditor General of India;

(vii) “Consolidated Fund” means the Consolidated Fund of India referred to in Article 266 (1) of the Constitution;

(vill) “Constitution” means the Constitution of India;

(ix) “Contingency Fund” means the Contingency Fund of India established under the Contingency Fund of India Act, 1950, in terms of Article 267 (1) of the Constitution;

(x) “Controlling Officer’ means an officer entrusted by a Department of the Central Government with the responsibility of controlling the incurring of expenditure and/or the collection of revenue. The term shall include a Head of Department and also an Administrator;

(xi) “Department of the Government of India” means any of the Ministries, Departments, Secretariats and Offices as notified from time to time and listed in the First Schedule to the Government of India (Allocation of Business Rules);

(xii) “Drawing and Disbursing Officer” means a Head of Office and also any other Gazetted Officer so designated by a Department of the Central Government, a Head of Department or an Administrator, to draw bills and make payments on behalf of the Central Government. The term shall also include a Head of Department or an Administrator where he himself discharges such function;

(xiii) “Ministry of Finance” means the Ministry of Finance of the Central Government;

(xiv) “Financial Year” means the year beginning on the ist of April and ending on the 3ist of March following;

(xv) “Government” means the Central Government;

(xvi) “Government Account” means the account relating to the Consolidated Fund, the Contingency Fund and the Public Account; as defined in these rules;

(xvii) “Head of the Department” means an authority or person (not below the rank of a Deputy Secretary to the Government of India), declared by the concerned Department in the Government of India as a Head of Department in relation to an identifiable establishment or establishments to exercise the delegated financial powers under these Rules;

(xvill) “Head of Office’ means (a) a Gazetted Officer declared as such in the Delegation of Financial Powers Rules and (b) any other authority declared as such under any general or special orders of the competent authority;

(xix) “Local Body” means an authority legally entitled or specially empowered by Government to administer a local fund;

(xx) “Local Fund” means a local fund as defined in Rule 652 of the Treasury Rules;

(xxi) “Non-recurring expenditure” means expenditure other than recurring expenditure;

(xxii) “President” means the President of India;

(xxiii) “Primary unit of appropriation” means a primary unit of appropriation referred to in Rule 8 of the Delegation of Financial Powers Rules;

(xxiv) “Public Account” means the Public Account of India referred to in Article 266 (2) of the Constitution;

(xxv) “Public Works” means civil/ electrical works including public buildings, public services, transport infrastructure etc., both original and repair works and any other project, including infrastructure which is for the use of general public;

(xxvi) “Re-appropriation” means the transfer of funds from one primary unit of appropriation to another such unit;

(xxvii) “Recurring expenditure” means the expenditure which is incurred at periodical intervals for the same purpose. Expenditures other than recurring expenditure are nonrecurring expenditure;

(xxviii) “Reserve Bank” means the Reserve Bank of India or any office or agency of the Reserve Bank of India and includes any Bank acting as the agent of the Reserve Bank of India in accordance with the provisions of the Reserve Bank of India Act, 1934 (Act II of 1934);

(xxix) “Subordinate authority” means a Department of the Central Government or any authority subordinate to the President;

(xxx) “Treasury Rules” means the Treasury Rules of the Central Government;

(xxxi) CAPEX model: In the CAPEX Model, Capital expenditures is used by the buyer to straightway purchase goods followed by procurement of consumables, arranging comprehensive maintenance contract after warranty period and finally disposing the product after useful life;

(xxxii) OPEX model: In the OPEX model, the Seller provides the goods, maintains it and also provides the consumables as required and finally takes back the goods after useful / contracted life. The expenditure is made by the Buyer in a staggered manner as per the terms and conditions of the contract.