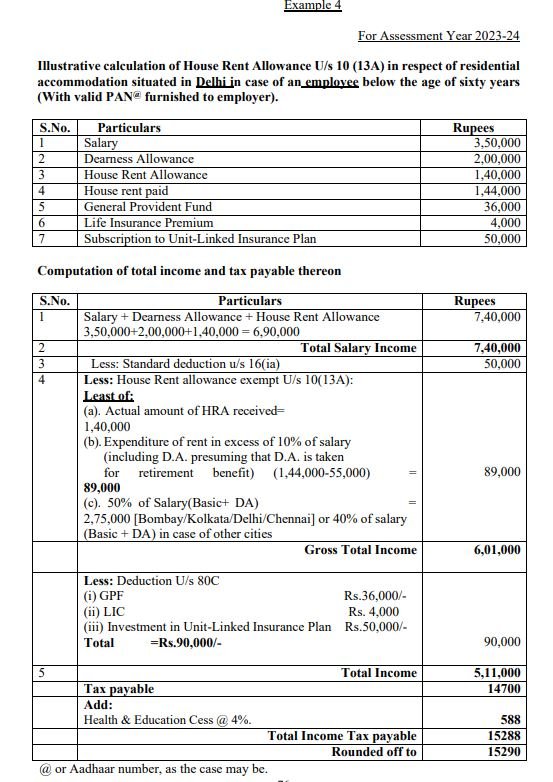

Income tax Calculation Example 4 For Assessment Year 2023-24 – Example 4

Example 4

For Assessment Year 2023-24

Illustrative calculation of House Rent Allowance U/s 10 (13A) in respect of residential accommodation situated in Delhi in case of an employee below the age of sixty years (With valid PAN furnished to employer).

| S.No. | Particulars | Rupees |

| 1 | Salary | 3.50,000 |

| 2 | Dearness Allowance | 2,00,000 |

| 3 | House Rent Allowance | 1,40,000 |

| 4 | House rent paid | 1,44,000 |

| 5 | General Provident Fund | 36,000 |

| 6 | Life Insurance Premium | 4,000 |

| 7 | Subscription to Unit-Linked Insurance Plan | 50,000 |

Computation of total income and tax payable thereon

| S.No. | Particulars | Rupees |

| I | Salary + Dearness Allowance + House Rent Allowance 3,50,000+2,00,000+1,40,000 = 6,90,000 | 7.40,000 |

| 2 | Total Salary Income | 7,40,000 |

| 3 | Less: Standard deduction u/s 16(ia) | 50,000 |

| 4 | Less: House Rent allowance exempt U/s 10(13A): least ta (a).Actual amount of HRA received= 1,40,000 (b).Expenditure of rent in excess of 10% of salary (including D.A. presuming that D.A. is taken for retirement benefit) (1,44,000-55,000) 89,000 (c).50% of Salary(Basic+ DA) – 2,75,000 [Bombay/Kolkata/Delhi/Chennai] or 40% of salary (Basic + DA) in case of other cities | 89 |

| Gross Total Income | 601,000 | |

| Less: Deduction U/s 80C (i)GPF Rs.36,000/- (ii)LIC Rs. 4,000 (iii)Investment in Unit-Linked Insurance Plan Rs.50,000/- Total =Rs.90.000/- | 90 | |

| 5 | Total Income | 5,11,000 |

| Tax payable | 14700 | |

| Add: Health & Education Cess @ 4%. | 588 | |

| Total Income Tax pay able | 15288 | |

| Rounded off to | 15290 |

or Aadhaar number, as the case may be. # It may be noted that tax liability may not be the same in case the taxpayer opts for concessional tax regime under section 115BAC of the Act.