- Revision of rates of Dearness Allowance to Central Government employees-effective from 01.01.2024.

- Cabinet Nod: Central Government Employees to Receive 4% Hike in Dearness Allowance

- Grant of Dearness Relief to Railway pensioners/family pensioners—Revised Rates effective from 01.07.2023

- How to Calculate Dearness Allowance 2024 – A Simple Formula

- Tamil Nadu Government Announces 4% Dearness Allowance Hike for Its Employees

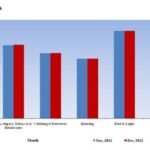

- Expected Dearness Allowance From January 2024

- DA Hike of 212%-221% Announced for Railway Employees in 6th CPC Grade Pay

- DPE IDA & DA Order April 2023

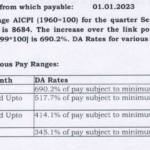

- Payment of Dearness Allowance to Gramin Dak Sevaks (GDS) effective from 01.01.2023

- Dearness Allowance Order for Armed Forces and PBOR effective from Jan 2023

- Union Cabinet approves 4% increase in Dearness Allowance for Central Government employees and pensioners

- DR payable to Pensioners for the period Feb 2023 to July 2023 – IBA

- Further Installment of DR Announced by Tripura Government

- AICPIN for the month of December 2022

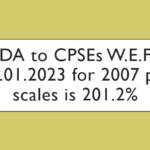

- DA to CPSEs w.e.f 01.01.2023 for 2007 pay scales is 201.2%

- DA to CPSEs w.e.f. 01.01.2023 for 2017 Pay Scales is 37.2%

- 408.4% DA from 01.01.2023 to CPSEs Revision of scales of pay w.e.f. 01.01.1997

- Rates of DA payable to the executives of CPSEs on 1987 & 1992 basis

- DA to the CDA pattern employees of CPSEs on 6th CPC pay scales from 01.07.2022

- DA to Central Government and CAB as per 6th CPC from the existing rate of 203% to 212% of Basic Pay from 01.07.2022

- DA to Central Government and CAB as per 5th CPC from the existing rate of 381% to 396% of Basic Pay from 01.07.2022

- Payment of DA to GDS effective from 01.07.2022

- DA effective from 01.07.2022 to Armed Forces Officers and Personnel Below Officer Rank including NCs(E)

- Finmin : 7th CPC pay scales DA From July 2022 at 38% for CDA pattern employees of CPSEs

DR 2016

DA 2016

DA 2015

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.7.2015

- payment of Dearness Allowance to Central Government employees Revised Rates effective from 1.1.2015,

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.7.2015 (Hindi)

DR 2015

- Grant of Dearness Relief to Central Government pensioners/family pensioners — Revised rate effective from 1.7.2015.

- Grant of Dearness Relief to Central Government pensioners/family pensioners — Revised rate effective from 1.1.2015.

DA 2014

- Finance Ministry issued orders for the payment of Dearness Allowance at revised rates from 1.7.2014

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.1.2014

DR 2014

- Grant of Dearness Relief to Central Government pensioners/family pensioners — Revised rate effective from 1.7.2014.

- Grant of Dearness Relief to Central Government pensioners/family pensioners – Revised rate effective from 1.1.2014

DA 2013

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.7.2013

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.1.2013.

DR 2013

- Grant of Dearness Relief to Central Government pensioners/family pensioners – Revised rate effective from 1.7.2013

- Grant of Dearness Relief to Central Government pensioners/family pensioners — Revised rate effective from 1.1.2013

DA 2012

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.1.2012

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.7.2012

DR 2012

- Grant of Dearness Relief to Central Government pensioners/family pensioners — Revised rate effective from 1.7.2012.

- Grant of Dearness Relief to Central Government pensioners/family pensioners – Revised rate effective from 01.01.2012.

DA 2011

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.7.2011

- Payment of Dearness Allowance to Central Government Employees – Revised Rates effectives from 1.1.2011

DR 2011

- Grant of Dearness Relief to Central Government pensioners/family pensioners — Revised rate effective from 1.7.2011

- Grant of Dearness Relief to Central Government pensioners/family pensioners — Revised rate effective from 1.1.2011

DA 2010

- Payment of Dearness Allowance to Central Government Employees – Revised Rates effective from 1.7.2010.

- Payment of Dearness Allowance to Central Government Employees – Revised Rates effective from 1.1.2010.

DR 2010

- Grant of Dearness Relief to Central Government pensioners/family pensioners – Revised rate effective from 1.7.2010.

- Grant of Dearness Relief to Central Government pensioners/family pensioners – Revised rate effective from 1.1.2010.

DA 2009

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.7.2009.

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.1.2009

DR 2009

- Grant of Dearness Relief to Central Government pensioners/family pensioners – Revised rate effective from 1-7-2009.

- Grant of dearness relief to Central Government pensioners/family pensioners – Revised rate effective from 1-1-2009.

DA 2008

- Sixth Central Pay Commission-Decision of Government relating to grant of Dearness Allowance to Central Government Servants-Revised rates effective from 1.1.2006,1.7.2006,1.1.2007,1.7.2007,1.1.2008 and 1.7.2008

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 01.01.2006

DR 2008

- Grant of Dearness Relief to pensioners/family pensioners-Corrigendum (dated 25/09/2008)

- Corrigendum – Recommendation of 6th Central Pay Commission – Decision of Government relating to grant of Dearness Relief to Central Government Pensioners/family pensioners – revised rate effective from 1-1-2006,1-7-2006,1-1-2007,1-7-2007,1-1-2008 and 1-7-2008

- Grant of Dearness Relief to pensioners/family pensioners (dated 12/09/2008)

- Grant of dearness relief to Central Government pensioners/family pensioners – Revised rate effective from 01.01.2008

DA 2007

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.7.2007

- Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.1.2007

DR 2007

- Grant of dearness relief to Central Government pensioners/family pensioners – Revised rate effective from 01.07.2007

- Grant of dearness relief to Central Government pensioners/family pensioners – Revised rate effective from 01.01.2007.

DA 2006

- Payment of Dearness Allowance to Central Government Employees – Revised Rates effective from 1.7.2006 and Deputation

- Payment of Dearness Allowances to Central Government employees – Revised Rates effective from 01.01.2006.

DR 2006

- Grant of dearness relief to Central Government pensioners/family pensioners – Revised rate effective from 01.07.2006.

- Grant of dearness relief to Central Government pensioners/family pensioners – Revised rate effective from 01.01.2006

DA 2005

Payment of Dearness Allowance to Central Government Employees Revised rates effective from 1.1.1999

Leave a Reply