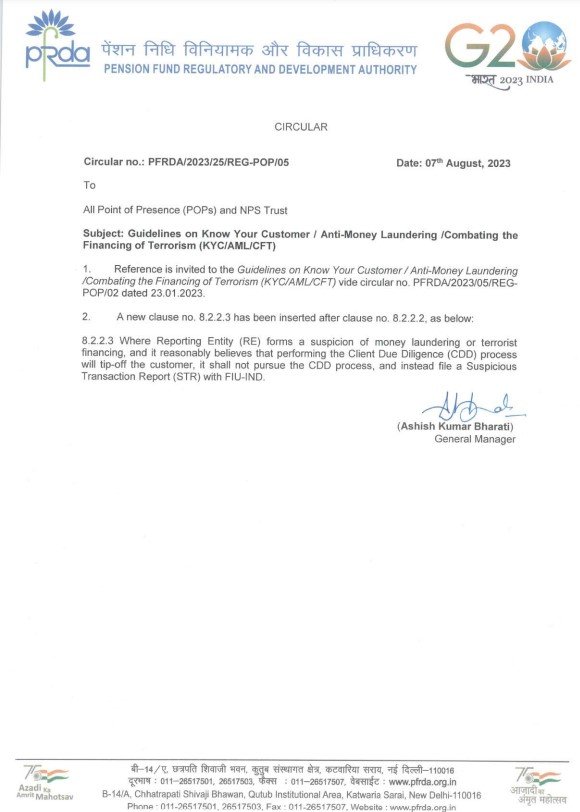

The Pension Fund Regulatory and Development Authority (PFRDA) has issued a circular (no. PFRDA/2023/25/REG-POP/05) dated August 7, 2023, addressed to all Point of Presence (POPs) and NPS Trust.

The circular pertains to the implementation of Guidelines on Know Your Customer (KYC), Anti-Money Laundering (AML), and Combating the Financing of Terrorism (CFT). The guidelines were initially provided in circular no. PFRDA/2023/05/REG on January 23, 2023.

Guidelines on Know Your Customer / Anti-Money Laundering /Combating the Financing of Terrorism (KYC/AML/CFT)

पेंशन विनियामक और विकास प्राधिकरण

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

CIRCULAR

Circular no.: PFRDA/2023/25/REG-POP/05

Date: 07 August, 2023

To

All Point of Presence (POPs) and NPS Trust

Subject: Guidelines on Know Your Customer / Anti-Money Laundering /Combating the Financing of Terrorism (KYC/AML/CFT)

- Reference is invited to the Guidelines on Know Your Customer / Anti-Money Laundering /Combating the Financing of Terrorism (KYC/AML/CFT) vide circular no. PFRDA/2023/05/REG 23.01.2023.

- A new clause no. 8.2.2.3 has been inserted after clause no. 8.2.2.2, as below:

8.2.2.3 Where Reporting Entity (RE) forms a suspicion of money laundering or terrorist financing, and it reasonably believes that performing the Client Due Diligence (CDD) process will tip-off the customer, it shall not pursue the CDD process, and instead file a Suspicious Transaction Report (STR) with FIU-IND.

(Ashish Kumar Bharati)

General Manager

Source: https://www.pfrda.org.in/

Leave a Reply