In Rajya Sabha Unstarred Question No. 2307, Dr. Radha Mohan Das Agrawal asked the Minister of Finance three questions related to the pension fixation procedure under the General Financial Rules (GFR). In response, the Minister of State in the Ministry of Finance, Shri Pankaj Chaudhary, stated that the GFRs apply only to Central Government Ministries/Departments and their attached and subordinate bodies. The provisions of GFRs may also be applicable to central autonomous bodies unless separate financial rules approved by the Government exist. The fixation of pension at the State level through an administrative order remains legally tenable since the service conditions of State Government employees do not come under the purview of the Central Government.

Pension Fixation Procedure under GFR

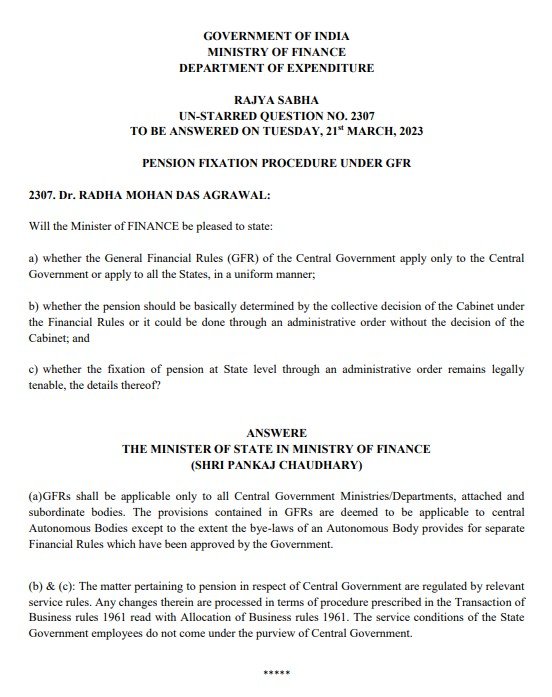

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF EXPENDITURE

RAJYA SABHA

UN-STARRED QUESTION NO. 2307

TO BE ANSWERED ON TUESDAY, 21% MARCH, 2023

PENSION FIXATION PROCEDURE UNDER GFR

- Dr. RADHA MOHAN DAS AGRAWAL:

Will the Minister of FINANCE be pleased to state:

a) whether the General Financial Rules (GFR) of the Central Government apply only to the Central Government or apply to all the States, in a uniform manner;

b) whether the pension should be basically determined by the collective decision of the Cabinet under the Financial Rules or it could be done through an administrative order without the decision of the Cabinet; and

c) whether the fixation of pension at State level through an administrative order remains legally tenable, the details thereof?

ANSWER

THE MINISTER OF STATE IN MINISTRY OF FINANCE

(SHRI PANKAJ CHAUDHARY)

(a) GFRs shall be applicable only to all Central Government Ministries/Departments, attached and subordinate bodies. The provisions contained in GFRs are deemed to be applicable to central Autonomous Bodies except to the extent the bye-laws of an Autonomous Body provides for separate Financial Rules which have been approved by the Government.

(b) & (c): The matter pertaining to pension in respect of Central Government are regulated by relevant service rules. Any changes therein are processed in terms of procedure prescribed in the Transaction of Business rules 1961 read with Allocation of Business rules 1961. The service conditions of the State Government employees do not come under the purview of Central Government.

Leave a Reply