The Indian Ministry of Personnel, Public Grievances and Pensions has received representations from various unions/associations of central government employees across the country to discontinue the New Pension Scheme (NPS) and implement the Old Pension Scheme (OPS). However, the government has not taken any action to meet their demands and is not considering reverting to the old pension scheme. The National Pension System (NPS) was introduced for Central Government employees in 2004, and the Central Civil Services (Pension) Rules, 1972 were amended accordingly. The government has taken several steps to streamline the NPS for central government employees and protect their interests, including increasing the government’s contribution to 14%, allowing subscribers to choose pension funds, payment of compensation for non-deposit or delayed deposit of NPS contributions, and tax exemptions under Section 80C of the Income Tax Act, 1961.

Demands for Reverting to Old Pension Scheme

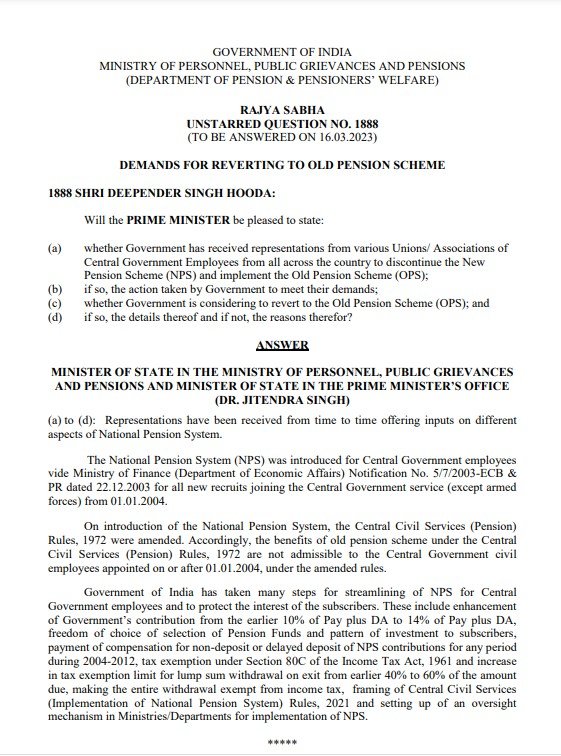

GOVERNMENT OF INDIA

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

(DEPARTMENT OF PENSION & PENSIONERS’ WELFARE)

RAJYA SABHA

UNSTARRED QUESTION NO. 1888

(TO BE ANSWERED ON 16.03.2023)

DEMANDS FOR REVERTING TO OLD PENSION SCHEME

1888 SHRI DEEPENDER SINGH HOODA:

Will the PRIME MINISTER be pleased to state:

(a) whether Government has received representations from various Unions/ Associations of Central Government Employees from all across the country to discontinue the New Pension Scheme (NPS) and implement the Old Pension Scheme (OPS);

(b) if so, the action taken by Government to meet their demands;

(c) whether Government is considering to revert to the Old Pension Scheme (OPS); and

(d) if so, the details thereof and if not, the reasons therefor?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS AND MINISTER OF STATE IN THE PRIME MINISTER’S OFFICE (DR. JITENDRA SINGH)

(a) to (d): Representations have been received from time to time offering inputs on different aspects of National Pension System.

The National Pension System (NPS) was introduced for Central Government employees vide Ministry of Finance (Department of Economic Affairs) Notification No. 5/7/2003-ECB & PR dated 22.12.2003 for all new recruits joining the Central Government service (except armed forces) from 01.01.2004.

On introduction of the National Pension System, the Central Civil Services (Pension) Rules, 1972 were amended. Accordingly, the benefits of old pension scheme under the Central Civil Services (Pension) Rules, 1972 are not admissible to the Central Government civil employees appointed on or after 01.01.2004, under the amended rules.

Government of India has taken many steps for streamlining of NPS for Central Government employees and to protect the interest of the subscribers. These include enhancement of Government’s contribution from the earlier 10% of Pay plus DA to 14% of Pay plus DA, freedom of choice of selection of Pension Funds and pattern of investment to subscribers, payment of compensation for non-deposit or delayed deposit of NPS contributions for any period during 2004-2012, tax exemption under Section 80C of the Income Tax Act, 1961 and increase in tax exemption limit for lump sum withdrawal on exit from earlier 40% to 60% of the amount due, making the entire withdrawal exempt from income tax, framing of Central Civil Services (Implementation of National Pension System) Rules, 2021 and setting up of an oversight mechanism in Ministries/Departments for implementation of NPS.

Leave a Reply