The Pension Fund Regulatory and Development Authority (PFRDA) has issued a circular to all Point of Presence (POPs) outlining guidelines on Know Your Customer (KYC), Anti-Money Laundering (AML), and Combating the Financing of Terrorism (CFT). The circular states that entities registered as POPs are required to comply with the requirements of the Prevention of Money Laundering Act, 2002 as per Regulation 15 of the PFRDA (Point of Presence) Regulations, 2018. The guidelines are effective from the date of issuance, and provisions for re-KYC of existing subscribers will be effective from April 1, 2023. The circular is signed by the Executive Director, Sumeet Kaur Kapoor.

Guidelines on Know Your Customer / Anti-Money Laundering / Combating the Financing of Terrorism (KYC/AML/CFT)

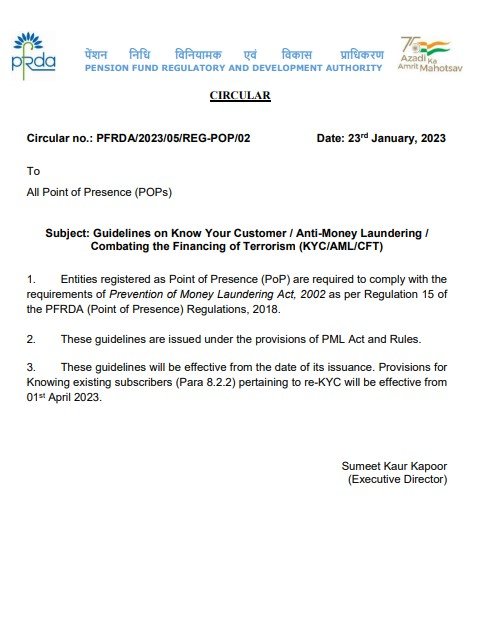

पेंशन निधि विनियामक एवं विकास प्राधिकरण

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

CIRCULAR

Circular no.: PFRDA/2023/05/REG-POP/02

Date: 23 January, 2023

To

All Point of Presence (POPs)

Subject: Guidelines on Know Your Customer / Anti-Money Laundering / Combating the Financing of Terrorism (KYC/AML/CFT)

- Entities registered as Point of Presence (PoP) are required to comply with the requirements of Prevention of Money Laundering Act, 2002 as per Regulation 15 of the PFRDA (Point of Presence) Regulations, 2018.

- These guidelines are issued under the provisions of PML Act and Rules.

- These guidelines will be effective from the date of its issuance. Provisions for Knowing existing subscribers (Para 8.2.2) pertaining to re-KYC will be effective from 01st April 2023.

Sumeet Kaur Kapoor

(Executive Director)

Leave a Reply