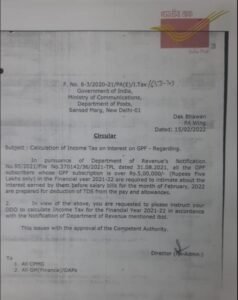

Calculation of Income Tax on Interest on GPF- DOP

F. No. 8-3/2020-21/PA(E)/I.Tax/653-703

Government of India,

Ministry of Communications,

Department of Posts,

Sansad Marg, New Delhl-01

Dak Bhawan

PA Wing

Dated: 15/02/2022

Circular

Subject : Calculation of Income Tax on Interest on GPF – Regarding.

In pursuance of Department of Revenue’s Notification No.95/2021/File No.370142/36/2021-TPL dated 31.08.2021, all the GPF subscribers whose GPF subscription is over Rs.5,00,000/- (Rupees Five Lakhs only) in the Financial year 2021-22 are required to intimate about the interest earned by them before salary bills for the month of February, 2022 are prepared for deduction of TDS from the pay and allowances.

2 In view of the above, you are requested to please instruct your DDO to calculate Income Tax for the Financial Year 2021-22 In accordance with the Notification of Department of Revenue mentioned ibid.

This issues with the approval of the Competent Authority.

Director (PA-Admn.)

Leave a Reply