No.19030/1/2017- E.IV

Government of India

Ministry of Finance

Department of Expenditure

North Block, New Delhi,

Dated the 6th January, 2022

OFFICE MEMORANDUM

Subject : Admissibility of Composite Transfer Grant (CTG) on Retirement.

References have been received in Department of Expenditure seeking clarification on admissibility of Composite Transfer Grant (CTG) in r/o Central Government employees on settlement after Retirement at the last station of duty or other than last station of duty. As per existing rules in this regard, one third of CTG is admissible at present for settling down at last station of duty or at a station not more than 20 km. from the last station of duty.

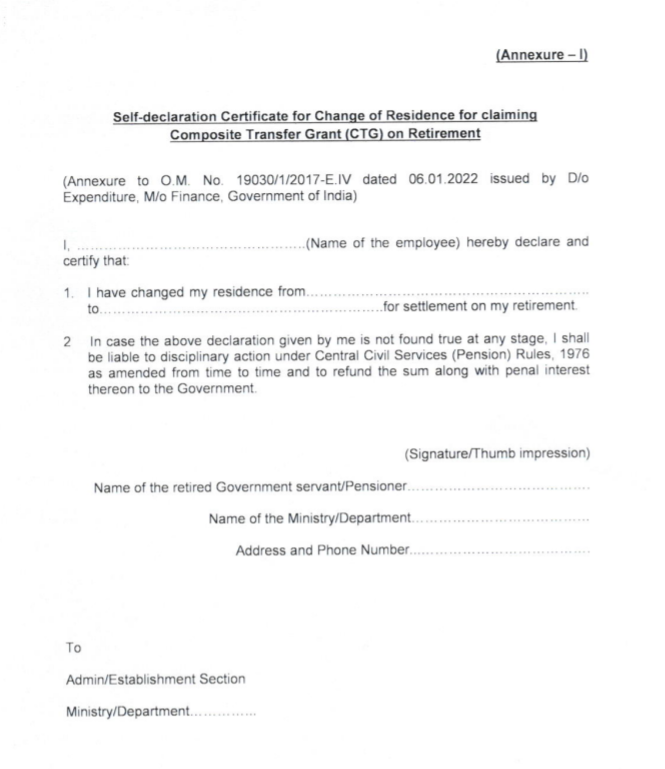

2.The matter has been considered in this Department. In partial modification of Para 4 (ii) (a) and (b) of the G.M. of even No. dated 13.07.2017, it has been decided that for the purpose of Composite Transfer Grant in rho Central Government employee who wishes to settle down at the last station of duty or other than last station of duty after retirement, the condition of 20 km. from the last station of duty, is done away with subject to the condition that change of residence is actually involved. To settle down at the last station of duty or other than last station of duty after retirement, full CTG would be admissible i.e. at the rate of 80% of the last month’s basic pay. The employee has to submit a Self-declaration Certificate regarding change of residence in prescribed format enclosed with this O.M. as Annexure — I.

3. In case of settlement to and from the Island territories of Andaman & Nicobar and Lakshadweep, CTG shall be paid at the rate of 100% of last month’s Basic Pay in terms of Para 4 (ii) (a) of this Department’s O.M. No. 19030/1/2017- E.IV dated 13.07 2017

4. In so far as the persons serving in the Indian Audit and Accounts Department are

concerned, these orders are issued in consultation with the Comptroller and Auditor General of India, as mandated under Article 148(5) of the Constitution of India.

5 These orders will be effective from the date of issue of the O.M.

6.This is issued with the approval of the Finance Secretary and Secretary (Exile diture).

Hindi version is attached.

S/d,

(Nirmala Dev)

Director

To.

All Ministries I Departments of the Government of India as per standard distribution list

[download id=”98779″ template=”dlm-buttons-button”]

Leave a Reply