Railways : Pension Scheme on Railways and Retirement Benefits on absorption in Public Sector Undertakings/Autonomous Bodies.

GOVERNMENT OF INDIA (BHARAT SARKAR)

MINISTRY 0 RAILWAYS (RAIL MANTRALAYA)

(RAILWAY BOARD)

M.C. No. 53(2021) RBE No. rg 2021

No. D-43/14/2019-F(E)III New Delhi, dated:ft+ .03.2021.

The General Managers,

All Indian Railways, Production Units, Metro Railway, Calcutta and others.

Sub: Pension Scheme on Railways and Retirement Benefits on absorption in Public Sector Undertakings/Autonomous Bodies.

Please find enclosed herewith a copy of Master Circular No. 53 regarding Pension and Retirement Death Gratuity for Railway Servants for information and necessary action.

(G.Priya Sudarsani),

Director, Finance (Estt.),

Railway Board.

DA: as above.

______________________________________________________________________________________________

GOVERNMENT OF INDIA (BHARAT SARKAR)

MINISTRY 0 RAILWAYS (RAIL MANTRALAYA)

(RAILWAY BOARD)

No. D-43/14/2019-F(E)III

M.C. No. 53(2021)

RBE No. 18 | 2021

To

The General Managers,

All Indian Railways, Production Units, Metro Railway, Calcutta and others.

New Delhi, dated:10.03.2021.

Pension rules are incorporated in the Indian Railway Establishment Code Vol. II (1985 edition) and the Manual of Railway Pension Rules (1993 edition). The manual embodies pension rules and orders as were issued from time to time in a self contained and readily understandable form. The manual however has not been updated after 1993 and during this period, large number of provisions have either become obsolete or have been substantially modified by issue of numerous orders. In view of this, a need has been felt for compiling some of the important instructions for the guidance of the staff dealing with the pension work in the form of Master Circulars.

2 Master Circular enclosed with this letter brings out instructions on the following subjects.

| Introduction of Pension Scheme on Railways and Pension options for the Railway employees who were governed by the PF Rules. | Part A |

| General Rules on pensionary matters | Part B |

| Retirement benefits for the Railway employees permanently absorbed in Public Sector Undertakings | Part C |

| Guidelines for timely payment of retirement dues to the retiring employee and the families of the employee and the families of the employee who die while in service. | Part D |

2. The instructions contained in the original circulars referred to have only prospective effect from the date of issue unless indicated otherwise in the concerned circular.

For dealing with old cases, the instructions in force at the relevant time should be referred to.

3. If any circular current on the subject has been lost sight of, the same should not be ignored and should be treated as valid and operative References to the orders on the basis of which the above chapters have been framed are indicated against each item of the chapter.

(G.Priya Sudarsani),

Director, Finance (Estt.),

Railway Board

______________________________________________

Part A

Introduction of Pension Scheme on Railways and Pension options for the employees governed by Provident Fund Scheme.

1. Pension Scheme was introduced on the Railways on 16.11.57 effective from 01.04.57 vide Railway Board’s letter No. F(E)/50/RTI/6 dated 16.11.57. All railway employees who entered in service on and after 16.11.57 are governed by the said Pension Scheme. The new Pension Scheme was practically an adoption of the provisions of the Railway Pension Rules 1950 promulgated as the “Liberalised Pension Rules, 1950” vide Railway Board’s letter No. E48-CPC/208 dated 8″‘ July 1950, as amended & clarified from time to time.

2. At the time of introduction of pension scheme on the Railways, pension option was also allowed to all those non-pensionable railway servants who were in service on 01.04.1957 or had joined railway service between 01.04.1957 and 16.11.1957 in preference to the Provident Fund Scheme by which they were governed. This option was open till 30.09.1959.

3. As a result of various improvement in the service conditions or implementation of the Pay Commission’s recommendations etc. fresh options were again allowed to the staff to join the pension scheme as these improvements had bearing on the pensionary benefits. In all, 12 such options were allowed. The details of these orders are as under:-

4. As per the last pension option order issued under Board’s letter No.PCIV/87/Imp/PN1 dated 08.05.1987, CPF beneficiaries who were in service on 01.01.1986 and those who continued to be in service on the date of issue of the said order were. however, automatically deemed to have come over to the Pension Scheme unless they specifically opted to continue under the Contributory Provident Fund Scheme. The last date for such option was 30.09.87

5. All pension option orders issued from time to time were made applicable retrospectively from the specified dates as mentioned in each order. The staff who had retired in the intervening period but were otherwise eligible to opt for the pension scheme were, therefore, also given the option to join the pension scheme by refunding the payment of settlement dues that they had received under the Contributory Provident Fund Scheme. Similarly, the families of the deceased employees who were eligible for these options were also allowed the option to join the pension scheme by refunding the payments they had received under the Provident Fund Scheme

6. Apart from the twelve options given to the staff referred to above, the families of the deceased railway employees were also given the following option to opt for the Pension Scheme by issue of following separate orders.

1. F(E)III/72/PN1/3 dated 15.09.1972

2. F(E)III/72/PN1/19 dated 19.09.72 & 18.12.72

3. F(E)I11/72/PN1/19 dated 07.04.75

4. F(E)III/79/PN1/4 dated 12.11.1979.

7. Besides the above orders, instructions were also issued under Board’s letter No. F(E)III/68/PN1/37 dated 07.10.1970 and 16.07.1971 as per which the request from the families of the employees, who had retained the Provident Fund Scheme and were either killed or died as a result of injuries sustained in the due performance of their duties were also considered on merits for being allowed to join the pension scheme. Further, under Board’s letter No. F(E)III/84/PN1/17 dated 16.07.85, families of railway employees who died in harness would also come over to the pension scheme.

Retirement benefits under Pension Rules.

Amount of pension

(1) In the case of a railway servant retiring in accordance with the provisions of pension rules before completing qualifying service of ten years, the amount of service gratuity shall be calculated at the rate of half month’s emoluments for every completed six-monthly period of service

(2) In the case of a railway servant retiring in accordance with the provisions of pension rules after completing the qualifying service of not less than ten years, the amount of pension shall be calculated at fifty per cent. of emoluments or average emoluments, whichever is more beneficial to him. subject to a minimum of Nine thousand per mensem and a maximum of 1. 25, 000/- rupees per mensem.

(Authority for minimum pension:- Board’s letter No. No. 2016/F(E)I11/1(1)/8 dt.12.08 16)

Retirement gratuity or death gratuity

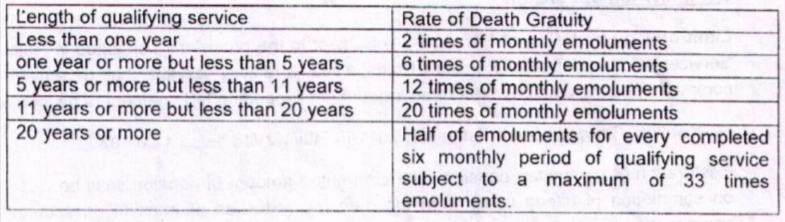

(1) (a) In the case of a railway servant. who has completed five years’ qualifying service and has become eligible for service gratuity or pension under pension rule, shall, on his retirement, be granted retirement gratuity equal to one fourth of his emoluments for each completed six monthly period of qualifying service subject to a maximum of sixteen and one-half times the emoluments and there shall be no ceiling on reckonable emoluments for calculating the gratuity. (b) If a railway servant dies while in service, the amount of death gratuity shall be paid to the family in the manner indicated in the Table below.

(iv) Service Gratuity

In the case of a railway servant retiring in accordance with the provisions of pension rules before completing qualifying service of ten years. the amount of service gratuity shall be calculated at the rate of half month s emoluments for every completed six-monthly period of service.

Pension for Temporary employees

Pensionary, terminal or death benefits to temporary railway servant. A temporary railway servant who retires on superannuation or on being declared permanently incapacitated for further railway service by the appropriate medical authority after having rendered temporary service not less than ten years shall be eligible for grant of superannuation, invalid pension, retirement gratuity and family pension at the same scale as admissible to permanent railway servant under these rules.

Family Pension

where a railway servant dies,— (a) after completion of one year of continuous service; or

(b) before completion of one year of continuous service, provided the deceased railway servant concerned immediately prior to his appointment to the service or post was examined by the appropriate medical authority and declared fit by that authority for railway service; or

(c) after retirement from service and was on the date of death in receipt of a pension, or compassionate allowance, the family of the deceased shall be entitled to family pension under the Family Pension Scheme for Railway Servants, 1964, the amount of which shall be determined at a uniform rate of thirty per cent. of basic pay. The upper ceiling on family pension will be 30% of the highest pay in the Government i.e. Rs. 2, 50, 000/-with effect from 01.01.2016.

Authority: Board’s letter No. 2016/F(E)III/1(1)/8 dt 12.08 16.

Commutation of Pension

Limit on Commutation of Pension – (1) Subject to the provisions contained in Railway Services (Commutation of Pension) Rules, 1993, a railway servant shall be entitled to commute for lump sum payment of an amount not exceeding forty percent of his pension

(Authorities. Railway Board’s letter No. 2011/F(E)III/1(2)/13 dated 14.01.03

Restoration of commuted pension- The commuted amount of pension shall be restored on completion of fifteen years from the date the reduction of pension on account of commutation becomes operative.

(Authorities: Railway Board’s letter No. 2011/F(E)I11/1(2)/13 dated 14 01.03 )

A pensioner who has commuted a portion of his pension and on 01.04 1985 or thereafter completed or will complete 15 years from his respective date of retirement will have his commuted portion of pension restored.

Commencement of qualifying service

Subject to provision pension rules, qualifying service of a railways servant shall commence from the date he takes charge of the post to which he is first appointed either substantively or in an officiating or temporary capacity:

Emoluments

The expression –

(a) “emoluments for the purpose of calculating various retirement and death benefits, means the basic pay as defined in clause (i) of rule 1303 of the Code which a railway servant was receiving immediately before his retirement or on the date of his death:

Provided that the stagnation increment shall be treated as emolument for calculation of retirement benefits;

(b) “pay’ in these rules means the pay in the revised scales under the Railway Services (Revised Pay) Rules, 2016.

Average emoluments

Average emoluments shall be determined with reference to the emoluments drawn by a railway servant during the last ten months of his service.

No pensionary benefits are admissible to a railway servant who is dismissed or is removed or resigns from the railway service.

(Authority: Letter No. F(E)III/77/PN1/11 dt. 05.08.77)

The authority competent to dismiss or remove a railway servant may, if the case is deserving of special consideration as per the laid down norms, sanction a Compassionate Allowance not exceeding 2/3rd of pension or gratuity or both with would have been admissible to him if he had retired on Compensation Pension.

A railway servant compulsorily retired from the service as a penalty may be granted by the authority competent to impose such a penalty pension or gratuity or both at a rate not less than 2/31° and not more than full Compensation Pension (earliesr Invalid Pension) or gratuity or both admissible to him on the date of his compulsory retirement.

Recovery and adjustment of Government or railway dues from pensionary benefits

(1) For the dues other than the dues pertaining to occupation of Government or Railway accommodation, the Head of Office shall take steps to assess the dues ”one year” before the date on which a railway servant is due to retire on superannuation.

(1A) The assessment of Government or Railway dues as above shall be completed by the Head of Office eight months prior to the date of retirement of the railway servant.

(Authority: File No. 2015/F(E)III/1(1 )14 dt.17.06.16)

(2) The railway or Government dues as ascertained and assessed. which remain outstanding till the date of retirement of death of the railway servant. shall be adjusted against the amount of the retirement gratuity or death gratuity or terminal gratuity and recovery of the dues against the retiring railway servant shall be regulated in accordance with the provisions of (4) below

(3) For the purposes of this rule, the expression “railway or Government dues” includes–

(a) dues pertaining to railway or Government accommodation including arrears of license fee, as well as damages (for the occupation of the Railway or Government accommodation beyond the permissible period after the date of retirement of allottee),. if any;

(Authority: Railway Board letter No F(E)111/2010/PNI/4 dated 28.03.12)

(b) dues other than those pertaining to railway or Government accommodation, namely balance of house-building or conveyance or any other advance, overpayment of pay and allowances, leave salary or other dues such as Post Office or Life Insurance premia, losses (including short collection in freight charges shortage in stores) caused to the Government or the railway as a result if negligence or fraud on the part of the railway servant while he was in service.

(4) (i) A claim against the railway servant may be on account of all or any of the following: –

(a) losses (including short collection in freight charges, shortage in stores) caused to the Government or the railway as a result of negligence or fraud on the part of the railway servant while he was in service:

(b) other Government dues such as over-payment on account of pay and allowances or other dues such as house rent, Post Office or Life Insurance Premia, or outstanding advance

(c) non-Government dues.

(ii) Recovery of losses specified in (a) of (i) above shall be made subject to the conditions laid down in rule 8 being satisfied from recurring pensions and also commuted value thereof, which are governed by the Pension Act. 1871 (23 of 1871). A recovery on account of item (a) of (i) above which cannot be made in terms of pension rule, and any recovery on account of items (b) and (c) of (i) above that cannot be made from these even with the consent of the railway servant, the same shall be recovered from retirement, death, terminal or service gratuity which are not subject to the Pensions Act, 1871 (23 of 1871). It is permissible to make recovery of Government dues from the retirement, death, terminal or service gratuity even without obtaining his consent, or without obtaining the consent of the member of his family in the case of a deceased railway servant

(iii) Sanction to pensionary benefits shall not he delayed pending recovery of any outstanding Government dues. If at the time of sanction, any dues remain unassessed or unrealised the following courses should be adopted. –

(a) In respect of the dues as mentioned in (a) of (i) above A suitable cash deposit may be taken from the railway servant or only such portion of the gratuity as may be considered sufficient, may be held over till the outstanding dues are assessed and adjusted.

(b) In respect if the dues as mentioned in (b) of (i) above

(1) The retiring railway servant may be asked to furnish a surety of a suitable permanent railway servant. If the surety furnished by him is found acceptable, the payment of his pension or gratuity or his last claim for pay. etc. should not be with held and the surety shall sign a bond in Form 2.

(2) If the retiring railway servant is unable or nor willing to furnish a surety, then action shall be taken as specified in (iii) above.

(3) The authority-sanctioning pension in each case shall be competent to accept the surety bond in Form 2 on behalf of the President.

(c) In respect of the dues as mentioned in (c) of (i) above. The Quasi- Government and non-Government dues, such as amounts payable by a railway servant to Consumer Cooperative Societies, Consumer Credit Societies or the dues payable to an autonomous organisation by a railway servant while on deputation may be recovered from the retirement gratuity which has become payable to the retiring railway servant provided he gives his consent for doing so in writing to the administration.

(iv) In all cases referred to in (a) and (b) of (I) above of 4 above, the amounts which the retiring railway servants are required to deposit or those which are with held from the gratuity payable to them shall not be disproportionately large and that such amount are not with held or the sureties furnished are not bound over for unduly long periods. To achieve this the following principles should be observed by all the concerned authorities:-

(a) The cash deposit to be taken or the amount of gratuity to be withheld should not exceed the estimated amount of the outstanding dues plus twenty-five per centum thereof.

(b) Dues mentioned in (I) of 4 above should be assessed and adjusted within a period of three months from the date of retirement of the railway servant concerned.

(c) Steps should be taken to see that there is no loss to Government on account of negligence on the part of the officials concerned while intimating and processing of a demand. The officials concerned shall be liable to disciplinary action in not assessing the Government dues in time and the question whether the recovery of the irrecoverable amount shall be waived or the recovery made from the officials held responsible for not assessing the Government dues in time should be considered on merits.

(d) As soon as proceeding of the nature referred to in pension rule are instituted. the authority which instituted the proceedings should without delay intimate the fact to the Account Officer

Part ‘C’

Retirement benefits for railway employees absorbed in Public Sector Undertakings.

**********

Pension on absorption in or under a corporation, company or body

(1) A railway servant who has been permitted to be absorbed in a service or post in or under a corporation or company wholly or substantially owned or controlled by the Central Government or a State Government or in or under a body controlled or financed by the Central Government or a State Government shall be deemed to have retired from service from the date of such absorption and subject to (3) below, he shall be eligible to receive retirement benefits, if any, from such date as may be determined, in accordance with the orders of the Railway applicable to him.

(Authority: Railway Board’s letter No. F(E)I11/2003/PN1/25 dated 20.01.05) Explanation: – Date of absorption shall be

(i) In case a railway employee joins a corporation or company or body on immediate absorption basis, the date on which he actually joins that corporation or company or body;

(ii) In case a railway employee initially joins a corporation or company or body on foreign service terms by retaining a lien under the railways, the date from which his unqualified resignation is accepted by the railways.

(2) The provisions of (1) shall also apply to a railway servant who is permitted to be absorbed in joint sector undertakings. wholly under the joint control of Central Government and State Governments/Union Territory Administrations or under the joint control of two or more State Governments/Union Territory Administrations or under the joint control of two or more State Governments or Union Territory Administrations.

(3) Where there is a pension scheme in a body controlled or financed by the Central Government in which a railway servant is absorbed, he shall be entitled to exercise option either to count the service rendered under the railways in that body for pension or to receive retirement benefit for the service rendered under the railways in accordance with the orders issued by the railways.

(Authority: Railway Board’s letter No. 2011/F (E) 11111(1)9 dated 23.09.13) Explanation: – Body means autonomous body or statutory body.

(A) Clarification was issued that resignation from railway service with a view to join Public Sector Undertaking shall be treated as good and sufficient from the point of view of administration to claim retirement benefits.

(Authority: F(E)111/66/PN1/25 dated 21.09.66)

(B) Absorbed railway servant in the event of his resignation within two years from the date of his absorption was required to obtain approval of the Government before he could take up any private employment.

(Authority: F(P)/67/PN1/18 dated 18 02.1970)

(C) The amount of commutation of pension of a portion of pension upto a maximum of one third was exempted from income tax payable the absorbed railway servant. Those who opted for lumpsum payment in lieu of pension. the lumpsum payment was treated as two components

The commuted value upto the normai limit of one third of pension and Terminal benefit equal to 2/3rd of pension from income tax, the terminal benefit component was chargeable to recipient was allowed to spread this amount evenly over the preceding three years for levy of income tax.

(D) Resignation with a view to absorption in Public Sector Undertaking was treated as deemed retirement. The amount of DCRG payable to the absorbed employee was exempted from income tax.

(Authority. F(P)/67/PN1/18 dated 10.09.1971)

(E) With effect from 21.06.67 the benefit of Family Pension Scheme, 1964 as incorporated in the Railway Pension Rules was allowed to the absorbed employee provided he was governed by the Pension Rules and was otherwise eligible for pension on the date of his absorption This was not allowed to a railway servant who was eligible only for service gratuity in lieu of pension. The benefit of family pension under the Public Sector Undertaking was not admissible or the absorbed employee was not covered under the Family Pension Scheme of the Enterprise for one reason or the other.

Authority: F(E)111,75/PN1/15 dated 29.01 76 F(E)I11/78/PN1/18 dated 24.08.78 F(E)I11/85/PN1/25 dated 26.12.85

(F) The absorbed railway servant was allowed option either to get the family pension from the Railways or from the Public Sector Undertaking subject to fulfillment of specified conditions.

(Authority. F(E)III90/PN1/8 dated 21.02.1990 & 25 06.1992)

(G) State Government and subsequently absorbed permanently in such organizations with the prior permission of the competent authority. allowed w.e.f. 09.01.94 pro-rata retirement benefits as admissible to permanent Railway employees absorbed permanently under the Autonomous Bodies controlled by the Central Government.

W.e.f. 31.03.87, Railway employees are required to join Public Sector Undertakings/Autonomous Bodies/Joint Sector Undertakings under the control of State Government on immediate absorption basis.

(Authority: F(E)III/84/PN1/5 dated 25.06.84 & F(E)I11/92/PN1/25 dated 16.03.93)

(H) Retirement benefits to a Railway servant who had applied on his own volition on the basis of his application in response to Press advertisement for posts in Public Sector Undertakings and Autonomous Bodies was also allowed the payment of retirement benefits as allowed to those who were permanently absorbed after deputation in public interest

(Authority. E(NG)/72/AP/12 dated 02.08.1972 E(NG)II/73/AP/11 dated 05 12.1975 E(NG)II 77/AP/19 dated 24.05.1978)

(I) Conditions for payment of pension on absorption consequent upon conversion of a Railway Department into a public sector undertaking.—

(1) On conversion of a Department of the Railway into a public sector undertaking, all railway servants of that Department shall be transferred en-masse to that public sector undertaking, on terms of foreign service without any deputation allowance till such time as they get absorbed in the said undertaking, and such transferred railway servants shall be absorbed in the public sector undertaking with effect from such date as may be notified by the Government.

(2) The Government shall allow the transferred railway servants an option to revert back to the railway or to seek permanent absorption in the public sector undertaking.

(3) The option referred to in (2) above shall be exercised by every transferred railway servant in such manner and within such period as may be specified by the Government.

(4) The permanent absorption of the railway servants as employees of the public sector undertaking shall take effect from the date on which their options are accepted by the Government and on and from the date of such acceptance, such employees shall cease to be Government servants and they shall be deemed to have retired from railway service

(5) Upon absorption of railway servants in the public sector undertaking, the posts which they were holding in the Government before such absorption shall stand abolished.

(6) The employees who opt to revert to railway service shall be redeployed through the surplus cell of the Government.

(7) The employees including quasi-permanent and temporary employees but excluding casual labourers, who opt for permanent absorption in the public sector undertaking shall, on and from the date of absorption. be governed by the rules and regulations or bye-laws of the public sector undertaking

(8) A permanent railway servant who has been absorbed as an employee of a public sector undertaking his family shall be eligible for pensionary benefits (including cornmutation of pension, gratuity, family pension or extraordinary pension), on the basis of combined service rendered by the employee in the Railways and in the public sector undertaking in accordance with the formula for calculation of such pensionary benefits as may be in force at the time of his retirement from the public sector undertaking or his death or at his option, to receive benefits for the service rendered under the Railways in accordance with the orders issued by the Government

Explanation – The amount of pension or family pension in respect of the absorbed employee on retirement from the public sector undertaking or on death shall be calculated in the same way as calculated in the case of a railway servant retiring or dy:ng on the same day.

(9) The pension of an employee under (8) above shall he calculated on fifty per cent of emoluments or average emoluments, whichever is more beneficial to him.

(10) In addition to pension or family pension, as the case may be, the employee who opts for pension on the basis of combined service shall also be eligible to dearness relief as per industrial dearness allowance pattern.

(11) The benefits of pension and family pension shall be available to quasi-permanent and temporary transferred railway servants after they have been confirmed in the public sector undertaking.

(12) A permanent railway servant absorbed in a public sector undertaking or a temporary or quasi-permanent railway servant who has been confirmed in a public sector undertaking subsequent to his absorption therein, shall be eligible to seek voluntary retirement after completing ten years of qualifying service with the Government and the public sector undertaking taken together, and such person shall be eligible for pensionary benefits on the basis of qualifying service.

(13) The Government shall create a pension fund in the form of a trust and the pensionary benefits of absorbed employees shall be paid out of such pension fund.

(14) The Member Staff, Railway Board shall be the Chairperson of the Board of Trustees which shall include representatives of the Ministries of Finance. Personnel. Public Grievances and Pensions, Labour, concerned public sector undertaking and their employees and experts in the relevant field to be nominated by the Government

(15) The procedure and the manner in which pensionary benefits are to be sanctioned and disbursed from the pension fund shall be determined by the Government on the recommendations of the board of trustees.

(16) The Government shall discharge its pensionary liability by paying in lump sum as a one time payment to the pension fund the pension or service gratuity and retirement gratuity for the service rendered till the date of absorption of the railway servant in the public sector undertaking

(17) The manner of sharing the financial liability on account of payment of pensionary benefits by the public sector undertaking shall be determined by the Government.

(18) Lump sum amount of the pension shall be determined in accordance with the Table of the values in Appendix to the Railway Services (Commutation of Pension) Rules, 1993

(19) The public sector undertaking shall make pensionary contribution to the pension fund for the period of service to he rendered by the concerned employees under that undertaking at the rates as may be determined by the board of trustees so that the pension fund shall be self supporting

(20) If, for any financial or operational reason, the trust is unable to discharge its liabilities fully from the Pension Fund and the public sector undertaking is also not in a position to meet the shortfall, the Government shall be liable to meet such expenditure and such expenditure shall be debited to either the fund or to the public sector undertaking.

(21) Payments of pensionary benefits of the pensioners of a railway Department on the date of conversion of it into a public sector undertaking shall continue to be the responsibility of the Government and the mechanism for sharing its liabilities on this account shall be determined by the Government.

(22) Upon conversion of a Railway Department into a public sector undertaking,—

(a) the balance of provident fund standing at the credit of the absorbed employees on the date of their absorption in the public sector undertaking shall with the consent of such undertaking, he transferred to the new provident fund account of the employees in such undertaking;

(b) earned leave and half pay leave at the credit of the employees on the date of absorption shall stand transferred to such undertaking; (c) the dismissal or removal from service of the public sector undertaking of any employee after his absorption in such undertaking for any subsequent misconduct shall not amount to forfeiture of the retirement benefits for the service rendered under the Railways and in the event of his dismissal or removal or retrenchment, the decisions of the undertaking shall be subject to review by the Ministry of Railways with the undertaking.

(23) In case the Government disinvests its equity in any public sector undertaking to the extent of fifty-one per cent or more, it shall specify adequate safeguards for protecting the interest of the absorbed employees of such public sector undertaking.

(24) The safeguards specified under (23) above shall include option for voluntary retirement or continued service in the undertaking or voluntary retirement benefits on terms applicable to railway servants or employees of the public sector undertaking as per option of the employees and assured payment of earned pensionary benefits with relaxation in period of qualifying service. as may be decided by the Government.

Conditions for payment of pension on absorption consequent upon conversion of a Railway Department into a Central autonomous body, –

(1) On conversion of a Department of the Railway into an autonomous body, all railway servants of that Department shall be transferred en-masse to that autonomous body on terms of foreign service without any deputation allowance till such time as they get absorbed in the said body and such transferred railway servants shall be absorbed in the autonomous body with effect from such date as may be notified by the Government

(2) The Government shall allow the transferred railway servants an option to revert back to the Government or to seek permanent absorption in the autonomous body.

(3) The option referred to in (2) above shall be exercised by every transferred railway servant in such manner and within such period as may be specified by the Government.

(4) The permanent absorption of the railway servants of the autonomous body shall take effect from the date on which their options are accepted by the Government and on and from the date of such acceptance, such employees shall cease to be railway servants and they shall be deemed to have retired from railway service.

(5) Upon absorption of railway servants in the autonomous body, the posts which they were holding in the Government before such absorption shall stand abolished.

(6) The employees who opt to revert to railway service shall be redeployed through the surplus cell of the Government.

(7) The employees including quasi-permanent and temporary employees but excluding casual labourers, who opt for permanent absorption in the autonomous body, shall on and from the date of absorption, be governed by the rules and regulations or bye-laws of the autonomous body

(8) A permanent railway servant who has been absorbed as an employee of an autonomous body and his family shall be eligible for pensionary benefits (including commutation of pension. gratuity, family pension or extra-ordinary pension), on the basis of combined service rendered by him in the Railways and autonomous body in accordance with the formula for calculation of such pensionary benefits as may be in force at the time of his retirement from the autonomous body or death or at his option, to receive benefits for the service rendered under the Railways in accordance with the orders issued by the Government.

Explanation:– The amount of pension or family pension in respect of the absorbed employee on retirement from autonomous body or death shall be calculated in the same way as would be the case with a railway servant retiring or dying on the same day.

(9) The pension of an employee under (8) above shall be calculated at fifty per cent of emoluments or average emoluments, whichever is more beneficial to him.

(10) In addition to pension or family pension, as the case may be, the absorbed employees who opt for pension on the basis of combined service shall also be eligible to dearness relief as per central dearness allowance pattern.

(11) The benefits of pension and family pension shall be available to quasi- permanent and temporary transferred railway servants after they have been confirmed in the autonomous body.

(12) The Government shall create a pension fund in the form of a trust and the pensionary benefits of absorbed employees shall be paid out of such pension fund

(13) The Mee-nber Staff, Railway i3oard shall be tne Chairperson of the ooard of trustees which shall include representatives of the fVlinisicies of Finance, Personnel, Public Grievances and Pensions, Labour, concerned autonomous body and their employees and experts in the relevant field to be nominated by the Government.

(14) The procedure and the manner in which pensionary benefits are to be sanctioned and disbursed from the pension fund shall be determined by the Government on the recommendations of the board of trustees.

(15) The Government shall discharge its pensionary liability by paying in lump sum as a one time payment to the pension fund the pension or service gratuity and retirement gratuity for the service rendered till the date of absorption of the railway servant in the autonomous body.

(16) The manner of sharing the financial liability on account of payment of pensionary benefits by the autonomous body shall be determined by the Government.

(17) Lump sum amount of the pension shall be determined in accordance with the Table of the values in Appendix to the Railway Services (Commutation of Pension) Rules. 1993.

(18) The autonomous body shall make pensionary contribution to the pension fund for the period of service to be rendered by the concerned employees under that body at the rates as may be determined by the Board of Trustees so that the pension fund shall be self-supporting.

(19) If, for any financial operational reason, the trust is unable to discharge its liabilities fully from the pension fund and the autonomous body is also not in a position to meet the shortfall, the Government shall be liable to meet such expenditure and such expenditure shall be debited to either the fund or to the autonomous body, as the case may be.

(20) Payments of pensionary benefits of the pensioners of a Railway Department on the date of conversion of it into an autonomous body shall continue to be the responsibility of the Government and the mechanism for sharing its liabilities on this account shall be determined by the Government.

(21) Upon conversion of a Department of the Railway into an autonomous body.—

(a) the balance of provident fund standing at the credit of the absorbed employees on the date of their absorption in the autonomous body shall, with the consent of such body. be transferred to the new provident fund account of the employees in such body

(b) earned leave and half pay leave at the credit of the employees on the date of absorption shall stand transferred to such body.

(c) the dismissal or removal from service of the autonomous body of any employee after his absorption in such body for any subsequent misconduct shall not amount to forfeiture of the retirement benefits for the service rendered under the Railways and in the event of his dismissal or removal or retrenchment, the decisions of the body shall be subject to review by the Ministry of Railways.

(22) In case the Government disinvests its equity in any autonomous body to the extent of fifty-one per cent. or more, it shall specify adequate safeguards for protecting the interest of the absorbed employees of such autonomous body.

(23) The safeguards specified under (22) above shall include option for voluntary retirement or continued service in the body, as the case may be or voluntary retirement benefits on terms applicable to railway employees or employees of the autonomous body as per option of the employees, assured payment of earned pensionary benefits with relaxation in period of qualifying service, as may be decided by the Government.”

(Authority: Railway Board’s letter No. 2011/F (E) III/1(1)9dated 23.09.13)

(I) The benefit of pro rata retirement benefits between Railways and Central Autonomous bodies is governed by the same sets of orders as are applicable for absorption of a railway servant in Public Sector Undertakings. As per the extant provisions, service rendered outside Central Government did not count for pension on Railways except in the case of scientific employees of autonomous bodies who are allowed the benefit of counting of service for pension on the Railways with effect from 29.08.84, Government decided to allow the benefit of counting of service for retirement benefits between Railways and the Central Autonomous Bodies and vice versa.

(Authority F(E)III/84/PN1/4 dated 25.09 84, 08.04.85)

Part ‘D’

Orders and procedure to be followed for timely payment of pensionary benefits to the retiring railway employee.

Delay in sanction of the payment of pensionary benefits involves hardship to the retiring employee. It is therefore imperative that the authorities dealing with the applications for pensionary benefits should act expeditiously so that the beneficiary receives his dues on due date. When delay is anticipated in sanction, the retiring employee may be granted provisional pension/gratuity or family pension/death gratuity, as the case may be on the basis of the information available with the head of the Office or the Railway Servant. Detailed procedure to deal with such cases as well as the procedure to be followed for sanctioning the pensionary benefits in time as issued from time to time are as under

1) F(E)III/76/PN1/3 dt. 08.04.76

II) F(E)III/76/PN1/3 dt. 15.10.76

III) E(G)/76/PN1/25 dt. 19.11.76

IV) F(E)III/79/PN1/3 dt. 01.09.1979

V) F(E)111/87/PN1/2 dt. 06.03.1987

VI) F(E)III/87/PN1/2 dt. 19 08.87

2. Order dated 08.04.1976 prescribes the time table to commence the work of preparing pension paper for payment of superannuation pension. procedure for determining qualifying service, average emoluments, treatment of extraordinary leave, period of suspension. break in service, period of deputation/foreign service dispensation of the requirement of administrative sanction to grant pension, procedure for payment of provisional pension where service records are not available. adjustment of government dues etc. Similarly orders dated 01.09.1979 prescribes details for finalising cases to grant pensionary benefits to the families of employees who die while in service.

3. In all cases, efforts are made to assess and adjust the recoverable dues within a period of 3 months from the date of retirement of Railway servant concerned. In any case, it is to be presumed that there is no claim against a Railway servant if none is made after his retirement within 15 months — if commercial debits are involved, and 6 months. if commercial debits are not involved.

In the case of retiring commercial staff, the limit of 15 months has been reduced to 6 months for payment of gratuity w.e.f. 01.08 88 which has further been reduced to 3 months w.e.f 30.12.91.

4. Cases of Railway Servants whose retirement occurs ahead of superannuation, the procedure for making payment of pensionary benefits in such cases is detailed Board’s letter No. E(G)/76/PN1/25 dated 19.11.76.

[download id=”114117″ template=”dlm-buttons-button”]

Leave a Reply