Income Tax Notification, Rules 2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 11th March, 2021

G.S.R. 170(E). —

In exercise of powers conferred by sections 200 and 203 read with section 295 of the Income- tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:—

1. Short title and commencement –

(1) These rules may be called the Income-tax (3rd Amendment) Rules, 2021

(2) They shall come into force on the 1st day of April, 2021.

2. In the Income-tax Rules, 1962, in Appendix II,-

(i) For Form 12BA, the following shall be substituted, namely:–

“FORM NO. 12BA

[See rule 26A(2)(b)]

Statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of employer :

2. TAN :

3. TDS Assessment Range of the employer :

4. Name, designation and Permanent Account Number or Aadhaar Number of employee :

5. Is the employee a director or a person with substantial interest in the company(where the employer is a company) :

6. Income under the head “Salaries” of the employee (other than from perquisites) :

7. Financial year :

8. Valuation of Perquisites :

- Details of tax,

(a) Tax deducted from salary of the employee under section 192(1)

(b) Tax paid by employer on behalf of the employee under section 192(1A)

(c) Total tax paid

(d) Date of payment into Government treasury

| S.No. | Nature of perquisites (see rule 3) | Value of perquisite as per rules (Rs.) | Amount, if any, recovered from the employee (Rs.) | Amount of perquisite chargeable to tax Col. (3) – Col. (4)(Rs.) |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) |

| 1. | Accommodation | |||

| 2. | Cars/Other automotive | |||

| 3. | Sweeper, gardener, watchman or personal attendant | |||

| 4. | Gas, electricity, water | |||

| 5. | Interest free or concessional loans | |||

| 6. | Holiday expenses | |||

| 7. | Free or concessional travel | |||

| 8. | Free meals | |||

| 9. | Free education | |||

| 10. | Gifts, vouchers, etc. | |||

| 11. | Credit card expenses | |||

| 12. | Club expenses | |||

| 13. | Use of movable assets by employees | |||

| 14. | Transfer of assets to employees | |||

| 15. | Value of any other benefit/amenity/service/privilege | |||

| 16. | Stock options allotted or transferred by employer being an eligible start-up referred to in section 80-IAC. | |||

| 17. | Stock options (non-qualified options) other than ESOP in col 16 above. | |||

| 18. | Contribution by employer to fund and scheme taxable under section 17(2)(vii). | |||

| 19. | Annual accretion by way of interest, dividend etc. to the balance at the credit of fund and scheme referred to in section 17(2)(vii) and taxable under section 17(2)(viia). | |||

| 20. | Other benefits or amenities | |||

| 21. | Total value of perquisites | |||

| 22. | Total value of profits in lieu of salary as per section 17(3) |

9. Details of tax,—

(a) Tax deducted from salary of the employee under section 192(1)

(b) Tax paid by employer on behalf of the employee under section 192(1A)

(c) Total tax paid

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

I, ___________, s/o _____________ working as _____________ (designation) do hereby declare on behalf of ____________ (name of the employer) that the information given above is based on the books of account, documents and other relevant records or information available with us and the details of value of each such perquisite are in accordance with section 17 and rules framed thereunder and that such information is true and correct.

Place Full Name

Date Designation

Signature of the person responsible for deduction of tax.”;

(ii) In Form 16, for Part B (Annexure), the following shall be substituted, namely :-

“PART B (Annexure)

| Details of Salary Paid and any other income and tax deducted | ||||

|---|---|---|---|---|

| A | Whether opting for taxation u/s 115BAC? | [YES/NO] | ||

| 1. | Gross Salary | |||

| (a) | Salary as per provisions contained in section 17(1) | Rs. … | ||

| (b) | Value of perquisites under section 17(2) (as per Form No. 12BA, wherever applicable) | Rs. … | ||

| (c) | Profits in lieu of salary under section 17(3) (as per Form No. 12BA, wherever applicable) | Rs. … | ||

| (d) | Total | Rs. … | ||

| (e) | Reported total amount of salary received from other employer(s) | Rs. … | ||

| 2. | Less: Allowances to the extent exempt under section 10 | |||

| (a) | Travel concession or assistance under section 10(5) | Rs. … | ||

| (b) | Death-cum-retirement gratuity under section 10(10) | Rs. … | ||

| (c) | Commuted value of pension under section 10(10A) | Rs. … | ||

| (d) | Cash equivalent of leave salary encashment under section 10(10AA) | Rs. … | ||

| (e) | House rent allowance under section 10(13A) | Rs. … | ||

| (f) | Amount of any other exemption under section 10 | |||

| clause … | Rs. … | |||

| clause … | Rs. … | |||

| clause … | Rs. … | |||

| clause … | Rs. … | |||

| clause … | Rs. … | |||

| … | Rs. … | |||

| (g) | Total amount of any other exemption under section 10 | Rs. … | ||

| (h) | Total amount of exemption claimed under section 10 [2(a)+2(b)+2(c)+2(d)+2(e)+2(g)] | Rs. … | ||

| 3. | Total amount of salary received from current employer [1(d)-2(h)] | Rs. … | ||

| 4. | Less: Deductions under section 16 | |||

| (a) | Standard deduction under section 16(ia) | Rs. … | ||

| (b) | Entertainment allowance under section 16(ii) | Rs. … | ||

| (c) | Tax on employment under section 16(iii) | Rs. … | ||

| 5. | Total amount of deductions under section 16 [4(a)+4(b)+4(c)] | Rs. … | ||

| 6. | Income chargeable under the head “Salaries” [(3+1(e)-5] | Rs. … | ||

| 7. | Add: Any other income reported by the employee under as per section 192 (2B) | |||

| (a) | Income (or admissible loss) from house property reported by employee offered for TDS | Rs. … | ||

| (b) | Income under the head Other Sources offered for TDS | Rs. … | ||

| 8. | Total amount of other income reported by the employee [7(a)+7(b)] | Rs. … | ||

| 9. | Gross total income (6+8) | Rs. … | ||

| 10. | Deductions under Chapter VI-A | |||

| Gross Amount | Deductible Amount | |||

| (a) | Deduction in respect of life insurance premia, contributions to provident fund etc. under section 80C | Rs. … | Rs. … | |

| (b) | Deduction in respect of contribution to certain pension funds under section 80CCC | Rs. … | Rs. … | |

| (c) | Deduction in respect of contribution by taxpayer to pension scheme under section 80CCD (1) | Rs. … | Rs. … | |

| (d) | Total deduction under section 80C, 80CCC and 80CCD(1) | Rs. … | Rs. … | |

| (e) | Deductions in respect of amount paid/deposited to notified pension scheme under section 80CCD (1B) | Rs. … | Rs. … | |

| (f) | Deduction in respect of contribution by Employer to pension scheme under section 80CCCD (2) | Rs. … | Rs. … | |

| (g) | Deduction in respect of health insurance premia under section 80D | Rs. … | Rs. … | |

| (h) | Deduction in respect of interest on loan taken for higher education under section 80E | Rs. … | Rs. … | |

| Gross Amount | Qualifying Amount | Deductible Amount | ||

| (i) | Total Deduction in respect of donations to certain funds, charitable institutions, etc. under section 80G | Rs. … | Rs. … | Rs. … |

| (j) | Deduction in respect of interest on deposits in savings account under section 80TTA | Rs. … | Rs. … | Rs. … |

| (k) | Amount deductible under any other provision(s) of Chapter VI-A | |||

| section … | Rs. … | Rs. … | Rs. … | |

| section … | Rs. … | Rs. … | Rs. … | |

| section … | Rs. … | Rs. … | Rs. … | |

| section … | Rs. … | Rs. … | Rs. … | |

| section … | Rs. … | Rs. … | Rs. … | |

| section … | Rs. … | Rs. … | Rs. … | |

| … | Rs. … | Rs. … | Rs. … | |

| (l) | Total of amount deductible under any other provision(s) ofChapter VI‐A | Rs. … | Rs. … | Rs. … |

| 11. | Aggregate of deductible amount under Chapter VI-A [10(a)+10(b)+10(c)+10(d)+10(e)+10(f)+10(g)+10(h)+10(i) 10(j)+10(l)] | Rs. … | ||

| 12. | Total taxable income (9-11) | Rs. … | ||

| 13. | Tax on total income | Rs. … | ||

| 14. | Rebate under section 87A, if applicable | Rs. … | ||

| 15. | Surcharge, wherever applicable | Rs. … | ||

| 16. | Health and education cess @ 4% | Rs. … | ||

| 17. | Tax payable (13+15+16-14) | Rs. … | ||

| 18. | Less: Relief under section 89 (attach details) | Rs. … | ||

| 19. | Net tax payable (17-18) | Rs. … | ||

| Verification | |

|---|---|

| I, …………………………….., son/daughter of ……………………………………….working in the capacity of .……………………………… (designation) do hereby certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements, and other available records. | |

| Place ………… | (Signature of person responsible for deduction of tax) |

| Date ………… | Full Name : ………………… |

Notes:

1. Government deductors to fill information in item I of Part A if tax is paid without production of an income-tax challan and in item II of Part A if tax is paid accompanied by an income-tax

2. Non-Government deductors to fill information in item II of Part

3. The deductor shall furnish the address of the Commissioner of Income-tax (TDS) having jurisdiction as regards TDS statements of the

4. If an assessee is employed under one employer only during the year, certificate in Form 16 issued for the quarter ending on 31st March 2021 of the financial year shall contain the details of tax deducted and deposited for all the quarters of the financial year.

5. (i) If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form 16 pertaining to the period for which such assessee was employed with each of the employers.

(ii) Part B (Annexure) of the certificate in Form No.16 may be issued by each of the employers or the last employer at the option of the assessee.

6. In Part A, in items I and II, in the column for tax deposited in respect of deductee, furnish total amount of tax, surcharge and health and education

7. Deductor shall duly fill details, where available, in item numbers 2(f) and 10(k) before furnishing of Part B (Annexure) to the ”;

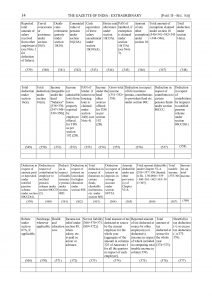

(iii) in Form No. 24Q, for “Annexure II”, the following Annexure shall be substituted, namely:–

Notes:

1.Salary includes wages, annuity, pension, gratuity (other than exempted under section 10(10), fees, commission, bonus, repayment of amount deposited under the Additional Emoluments (Compulsory Deposit) Act, 1974 (37 of 1974), perquisites, profits in lieu of or in addition to any salary or wages including payments made at or in connection with termination of employment, advance of salary, any payment received in respect of any period of leave not availed (other than exempted under section 10 (10AA), any annual accretion to the balance of the account in a recognised provident fund chargeable to tax in accordance with rule 6 of Part A of the Fourth Schedule of the Income-tax Act, 1961, any sums deemed to be income received by the employee in accordance with sub‐rule (4) of rule 11 of Part A of the Fourth Schedule of the Income-tax Act, 1961, any contribution made by the Central Government to the account of the employee under a pension scheme referred to in section 80CCD or any other sums chargeable to income-tax under the head ‘Salaries’.

2.Where an employer deducts from the emoluments paid to an employee or pays on his behalf any contributions of that employee to any approved superannuation fund, all such deductions or payments should be included in the statement.

3. Permanent Account Number of landlord shall be mandatorily furnished where the aggregate rent paid during the previous year exceeds one lakh rupees.

4. Permanent Account Number of lender shall be mandatorily furnished where the housing loan, on which interest is paid, is taken from a person other than a Financial Institution or the Employer.”.

[Notification No. 15/2021/F.No. 370142/04/2019-TPL]

ANKIT JAIN, Under Secy. (Tax Policy and Legislation)

Note: The principal rules were published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (ii) vide notification number S.O. 969(E) dated the 26th of March, 1962 and were last amended vide notification number G.S.R No. 162(E) dated the 09th of March, 2021.

[download id=”113019″ template=”dlm-buttons-button”]

Leave a Reply