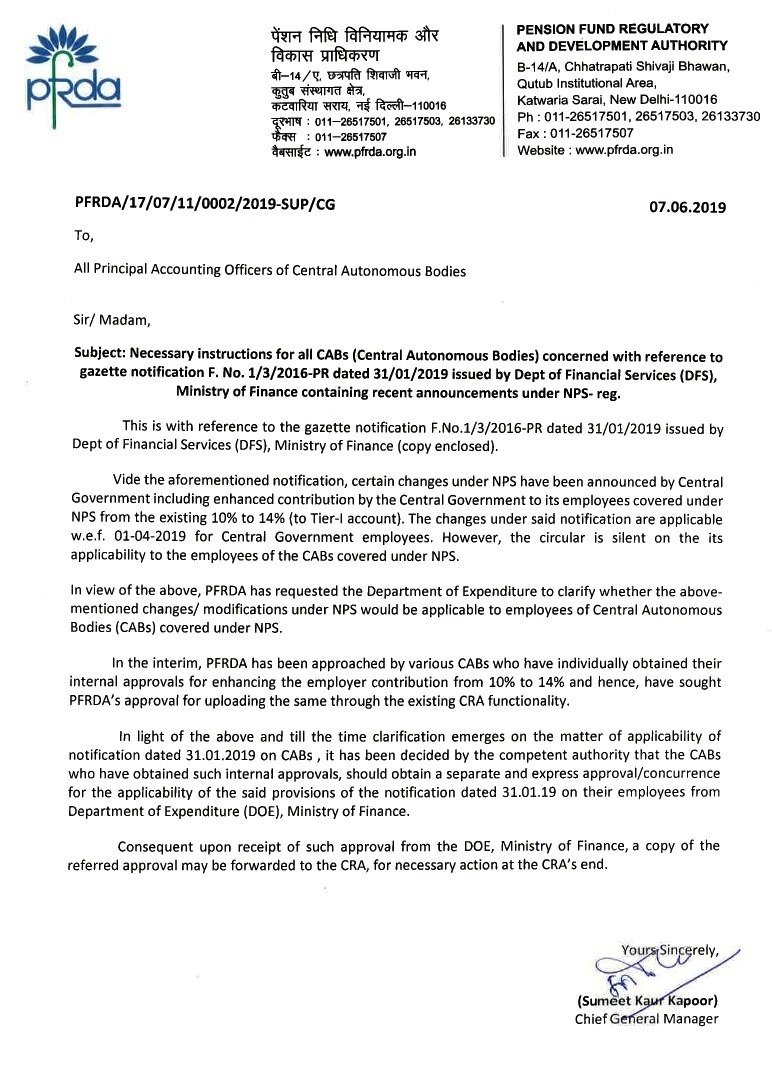

PFRDA – Instructions for all CABS (containing recent announcements under NPS)

PENSION FUND REGULATORY

AND DEVELOPMENT AUTHORITY

B-14/A, Chhatrapati Shivaji Bhawan,

Qutub Institutional Area,

Katwaria Sarai, New Delhi-110016

Ph : 011-26517501, 26517503, 26133730 Fax : 011-26517507

Website : www.pfrda.org.in

PFRDA/17/07/11/0002/2019-SUP/CG

07.06.2019

To,

All Principal Accounting Officers of Central Autonomous Bodies

Sir/ Madam,

Subject: Necessary instructions for all CABS (Central Autonomous Bodies) concerned with reference to gazette notification F. No. 1/3/2016-PR dated 31/01/2019 issued by Dept of Financial Services (DFS), Ministry of Finance containing recent announcements under NPS- reg.

This is with reference to the gazette notification F.No.1/3/2016-PR dated 31/01/2019 issued by Dept of Financial Services (DFS), Ministry of Finance (copy enclosed).

Vide the aforementioned notification, certain changes under NPS have been announced by Central Government including enhanced contribution by the Central Government to its employees covered under NPS from the existing 10% to 14% (to Tier-I account). The changes under said notification are applicable w.e.f. 01-04-2019 for Central Government employees. However, the circular is silent on the its applicability to the employees of the CABs covered under NPS.

In view of the above, PFRDA has requested the Department of Expenditure to clarify whether the above-mentioned changes/ modifications under NPS would be applicable to employees of Central Autonomous Bodies (CABs) covered under NPS.

In the interim, PFRDA has been approached by various CABs who have individually obtained their internal approvals for enhancing the employer contribution from 10% to 14% and hence, have sought PFRDA’s approval for uploading the same through the existing CRA functionality.

In light of the above and till the time clarification emerges on the matter of applicability of notification dated 31.01.2019 on CABs , it has been decided by the competent authority that the CABs who have obtained such internal approvals, should obtain a separate and express approval/concurrence for the applicability of the said provisions of the notification dated 31.01.19 on their employees from Department of Expenditure (DOE), Ministry of Finance.

Consequent upon receipt of such approval from the DOE, Ministry of Finance, a copy of the referred approval may be forwarded to the CRA, for necessary action at the CRA’s end.

Yours Sincerely,

(Sumeet Kapoor)

Chief General Manager

Leave a Reply