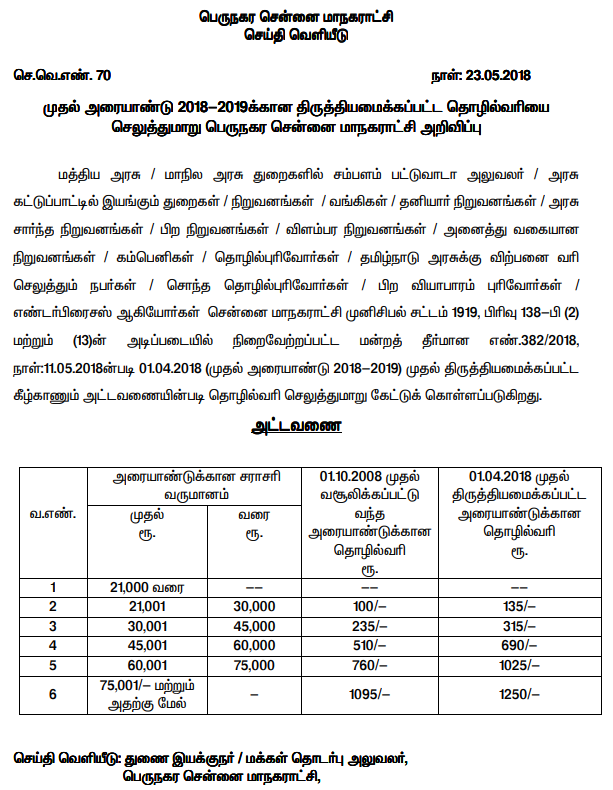

Professional Tax Rates for 2018-19 in Tamil Nadu

Professional Tax Rates has been revised for 2018-19 in Tamil Nadu. Professional Tax – Tax on Profession, trade, calling and employment. Government servant receiving pay from the revenue of the Central Government or any State Government. Profession Tax will be Collectable from the salary of August (Ist Quarter ) and January (IInd Quarter).

| Sl. No. | Average Half-Yearly Income (Rs.) |

Half-Yearly Old Tax Rates w.e.f.1.10.2008 (Rs) |

Half-Yearly New Tax Rates w.e.f. 1.4.2018 (Rs) |

|---|---|---|---|

| 1 | Up to 21,000 | – | – |

| 2 | 21,001 – 30,000 | 100 | 135 |

| 3 | 30,001 – 45,000 | 235 | 315 |

| 4 | 45,001 – 60,000 | 510 | 690 |

| 5 | 60,001 – 75,000 | 760 | 1025 |

| 6 | 75,001 and above | 1095 | 1250 |

Read Below for complete info:

Leave a Reply