On what basis is the minimum Pay Band & Grade Pay created?

Only in the 6th Pay commission, the new method of Running pay band and Grade Pay was introduced. Till the 5th pay commission, the Basic Pay was not divided, but in the 6th CPC, it was split in to Pay Band and Grade Pay.

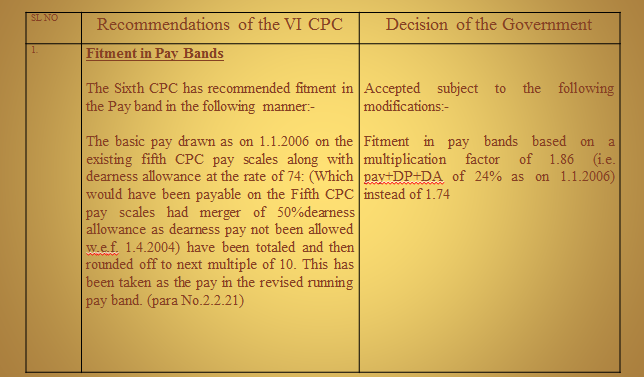

The Pay Band was calculated by putting together the 5th CPC Basic Pay, Dearness Pay and Dearness Allowance of 24% . (i.e. 1.86 Multiple factor in 6 CPC)

click here to get 7th pay commission project

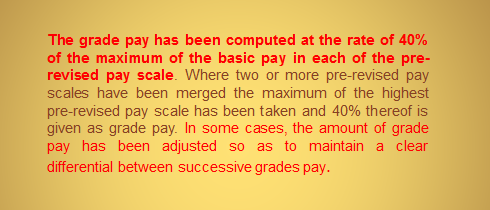

Grade pay taken from 40% Exiting maximum pre -revised pay scale (Details of 6th CPC Report attached)

In some cases, the amount of grade pay has been adjusted so as to maintain a clear differential between successive grades pay.(PB 3-PB4)

|

|

|

Pay Band Calculation Basic pay *1.86 |

Pay band(rounded of) |

Grade pay Calculation 40% Exiting maximum pay scale

|

Grade pay

|

|

S4 |

2750-70-3300-75-4400

|

2750*1.86=5115 PB1 |

5200-20200 |

4400*40/100=1760 |

1800 |

|

S5 |

3050-75-3950-80-4590 |

PB1 |

5200-20200 |

4590*40/100=1836 |

1900 |

|

S6 |

3200-85-4900 |

PB1 |

5200-20200 |

4900*40/100=1960 |

2000 |

|

S7 |

4000-100-6000 |

PB1 |

5200-20200 |

6000*40/100=2400 |

2400 |

|

S8 |

4500-125-7000 |

PB1 |

5200-20200 |

7000*40/100=2800 |

2800 |

|

S9 |

5000-150–8000 5000-8000,5500-9000 and Rs 6500-10500 (pre revised pay scale of Rs of Merged)

|

5000*1.86=9300 PB2 (START) |

9300-34800 |

(10500*40/100=4200

|

4200 |

|

S10 |

5500-175-9000 |

PB2 |

9300-34800 |

|

4200 |

|

S11 |

6500-200-6900 |

PB2 |

9300-34800 |

|

4200 |

|

S12 |

6500-200-10500 |

PB2 |

9300-34800 |

|

4200 |

|

S13 |

7450-250-11500 |

PB2 |

9300-34800 |

11500*40/100=4600 |

4600 |

|

S14 |

7500-250-12000 |

PB2 |

9300-34800 |

12000*40/100=4800 |

4800 |

|

S15 |

8000-275-13500 |

PB2 |

9300-34800 |

13500*40/100=5400 |

5400 |

|

|

|

|

|

|

|

|

GROUB A |

8000-275-13500 |

PB3 |

15600-39100 |

|

5400 |

|

S16 |

9000- |

|

15600-39100 |

|

5400 |

|

S17 |

9000-275-9550 |

|

15600-39100 |

|

5400 |

|

S18 |

10325-325-10975 |

|

15600-39100 |

|

|

|

S19 |

10000-325-15200-16500 |

|

15600-39100 |

16500*40/100=6600 |

6600 |

|

|

|

|

|

|

|

From the timetable given above, we can clearly understand how the Pay Band and Grade Pay are calculated. This calculation method generally applies for Pay Bands I and II. For Pay Bands III and IV it differs slightly. You can understand such changes by seeing the Fitment Table and Pay Fixation orders attached below.

7th Pay Commission Pay calculator and fixation formula Project

Leave a Reply